Late-Cycle Investment Theory

The foundation for the coming decade

Today's essay sets out what I call ‘late-cycle investment theory’, which I'm developing with reference to Carlota Perez's seminal work on technological revolutions.

It's not an exercise in academic truth-seeking but a practical tool for action. You should see it as a lens for spotting opportunities that consensus thinking may overlook, shaped by my years spent on both writing and practice.

Seen through a late-cycle lens, today's markets show signs that we've entered the maturity phase of the computing and networks revolution. The theory, therefore, leads to specific, testable predictions about where capital should go and which strategies will outperform.

Like any investment theory—from George Soros's reflexivity to Ray Dalio's debt cycles—this is a map, not the territory. Its value lies not in being definitively “right” but in surfacing non-consensus ideas and questioning conventional allocation strategies. At best, to borrow words from the late Andy Grove, it can become “a common language and a common way to frame the problem so that we can reach consensus around a counter-intuitive course of action.” As I apply this theory across hundreds of topics and industries over the months and years ahead, I'll refine it based on what proves useful and what does not. I'll also point out when I see signs that the theory is off or breaks down.

What follows is a first attempt at systematically applying late-cycle thinking to current market dynamics. The analysis covers four key themes: how technological maturity transforms innovation and strategy, why global institutions fragment under late-cycle pressures, the rise of new financial infrastructure to manage this complexity, and where the seeds of the next technological revolution may already be growing—particularly in China's approach to programmable electricity.

1/ Where are we in the current technological revolution?

Viewing markets through Carlota's theory suggests we're living through the 1970s of the age of computing and networks—not in mood, but in structure.

This isn't a metaphor. It's the basis for understanding how capital allocation must evolve if the current technological revolution has indeed reached maturity.

According to Carlota's model, presented in Technological Revolutions and Financial Capital, each technological revolution follows a predictable arc: chaotic Installation, financial bubble, productive Deployment, and finally, a maturity phase. My view is that we've clearly moved into that final stage, where the fog of uncertainty has lifted. Optimisation, not disruption, becomes the focus.

Consider what the 1970s actually looked like. The dominant techno-economic paradigm then was oil, automobiles, and mass production. By that decade, we'd hit a wall. Mass production no longer delivered returns in key industries, and even Detroit's carmakers faced a destructive trade-off between costs and defects.

My analysis suggests COVID revealed a similar dynamic for computing and networks. We pushed every digital capability to its limits during lockdowns, only to discover not just software's boundaries but something more telling: when physical interaction became possible again, people rushed back to offices, restaurants, and concerts. Marc Andreessen's 2011 claim that “software is eating the world” seems to have run into hard limits—technical, yes, but also human.

Three indicators support the late-cycle hypothesis:

The startup funding collapse of 2022 wasn't just a correction—it may be structural. As investor Jerry Neumann argued in his landmark Productive Uncertainty, startups rely on uncertainty as a competitive edge. When good ideas become obvious to everyone—including well-funded incumbents—the startup model faces real strain.

Then came AI, revealing new dynamics. ChatGPT's breakthrough didn't come from a garage startup but from OpenAI, backed by Microsoft's vast computing power. Google, Meta, and Amazon responded with billions. This pattern—big tech deploying huge capital against well-understood problems—fits the late-cycle theory exactly.

Most tellingly, platform saturation now looks almost complete. Digital transformation has reached most sectors where computing and networks can plausibly work. What remains—healthcare delivery, education, construction, government services—may reflect the paradigm's natural limits, not untapped markets.

This evidence points toward an era where capital discipline replaces capital frenzy, where strategy matters more than innovation, and where the winners will be those who understand that the real frontier lies not in inventing new technologies but in embedding existing ones into the physical world at a scale and precision we've never seen before.

2/ When innovation peaks, strategy decides

The late-cycle theory suggests that innovation loses its protective power as technological paradigms mature. When innovation stops being enough, strategy takes over.

Several indicators suggest we've reached that turning point—though investors, especially in venture capital, haven't updated their playbooks.

Early in any technological revolution, uncertainty runs high enough for ambitious founders to use innovation to escape market pressure. This worked brilliantly during the Installation phase of computing and networks, when the fog of uncertainty was thick enough to hide startups from incumbent attention.

But three observable shifts now mark what the theory sees as the move to maturity—each one eroding innovation's protective edge in ways that recall the 1970s inflection:

First, technological clarity has arguably arrived. The path to digitising business looks well-mapped. When AWS gives the same computing power to startups and giants, when development frameworks are commoditised, when AI models go open source within months—innovation advantages face severe pressure.

Second, application saturation may have set in. As I wrote in 2023, “the door is closing on startups” because we may have exhausted what I (inspired by both Paul Graham and Ben Horowitz) called the “bad-idea startups”—ventures that looked like bad ideas but were actually good. What remains are either truly bad ideas or obviously good ones that well-funded incumbents can also pursue.

Third, institutional constraints are visibly forming. In the age of oil, automobiles and mass production, it was labour law, collective bargaining, and Ralph Nader–inspired consumer protections. Today, it's GDPR, gig work regulation, and AI safety rules. These aren't inherently good or bad—they're society's natural response to a technology's revealed impact. But they tend to shift innovators' focus from disruption to compliance and efficiency.

This pattern resembles what happened in the 1970s as mass production plateaued. Three new industries rose to help the corporate world adapt: buyout firms imposed capital discipline through leverage, consulting firms specialised in strategy taught companies how to compete without relying on disruption-fueled growth, and the lobbying industry reshaped the link between business and government, helping firms entrench their position and blunt competition.

The evidence suggests we're shifting from a time when strong execution could mask weak strategy to one where defensibility and strategic clarity are prerequisites for survival. Those still chasing disruptive innovation in what may be a post-disruption world risk ending up in a corporate dead end. And those focused only on operational effectiveness, without a strategy, risk what Michael Porter calls “wars of attrition”—races to the bottom where no one wins.

3/ What drives the breakdown of global institutions in late cycles

The late-cycle theory holds that technological maturity breaks global institutions designed for earlier paradigms.

The pressures that technological maturity places on existing institutions help explain many current political phenomena. Donald Trump's rise and policies—however contradictory—can be understood as symptoms of these deeper structural forces rather than their cause. His simultaneous pursuit of manufacturing revival through tariffs whilst promoting dollar dominance through stablecoins isn't policy confusion but reveals the inevitable tensions of managing late-cycle transitions.

Current fragmentation trends, especially since Trump's “Liberation Day”, support this view.

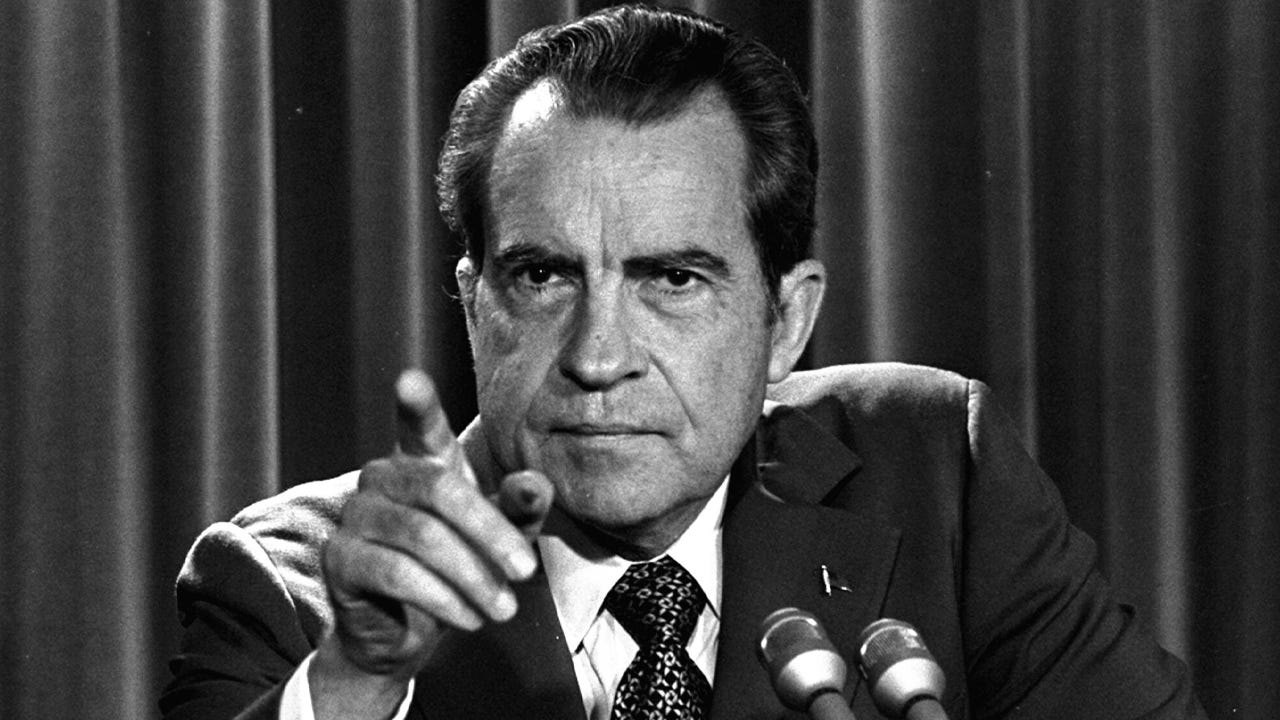

The gold standard is a telling precedent. It emerged during the age of steel, electricity and heavy engineering, when steamships, railways and submarine cables required fixed exchange rates for coordination. But as the next technological revolution took hold—marked by oil, automobiles and mass production—global value chains grew longer and more complex. These new pressures proved too much for the system to absorb, ultimately forcing Nixon to abandon the gold standard in 1971.

Today's fragmentation (the 'Trump Shock', 54 years after the 'Nixon Shock') appears to follow similar logic. Institutional breakdown became unavoidable as computing and networks created coordination challenges that legacy systems could no longer manage:

The Bretton Woods system, set up after World War II to restore fixed exchange rates ultimately backed by gold, assumed predictable trade flows between sovereign states producing distinct goods. But mature digital networks create real-time, many-to-many value chains where a single product draws on hundreds of suppliers across dozens of countries, coordinated through software platforms that update continuously.

China's rise as an advanced manufacturing powerhouse also contributes to the strain. By embedding software into manufacturing and partnering with Western corporate giants such as Apple, China has become remarkably successful at exporting goods while maintaining lower domestic consumption than Western economies. Whether this reflects deliberate systematic repression of domestic consumption or structural factors remains debated, but the resulting trade imbalances are without precedent and threaten systemic stability.

Seen through the late-cycle lens, what we're witnessing is not policy failure but technological inevitability. Computing and networks were meant to make globalisation frictionless, but instead introduced new layers of complexity and macroeconomic imbalance that overwhelmed existing institutions—much as mass production once overwhelmed the Bretton Woods system.

Among these pressures, the soaring trade deficit with China hollowed out manufacturing jobs, while the corresponding capital account surplus inflated asset prices—most notably in housing and stocks. This deepened inequality and fuelled the systemic risks that culminated in the 2008 global financial crisis, laying the ground for the political backlash that followed in America. In this context, the global order is not collapsing because of Trump; rather, Trump's rise is a symptom of mounting pressures that could only end in rupture.

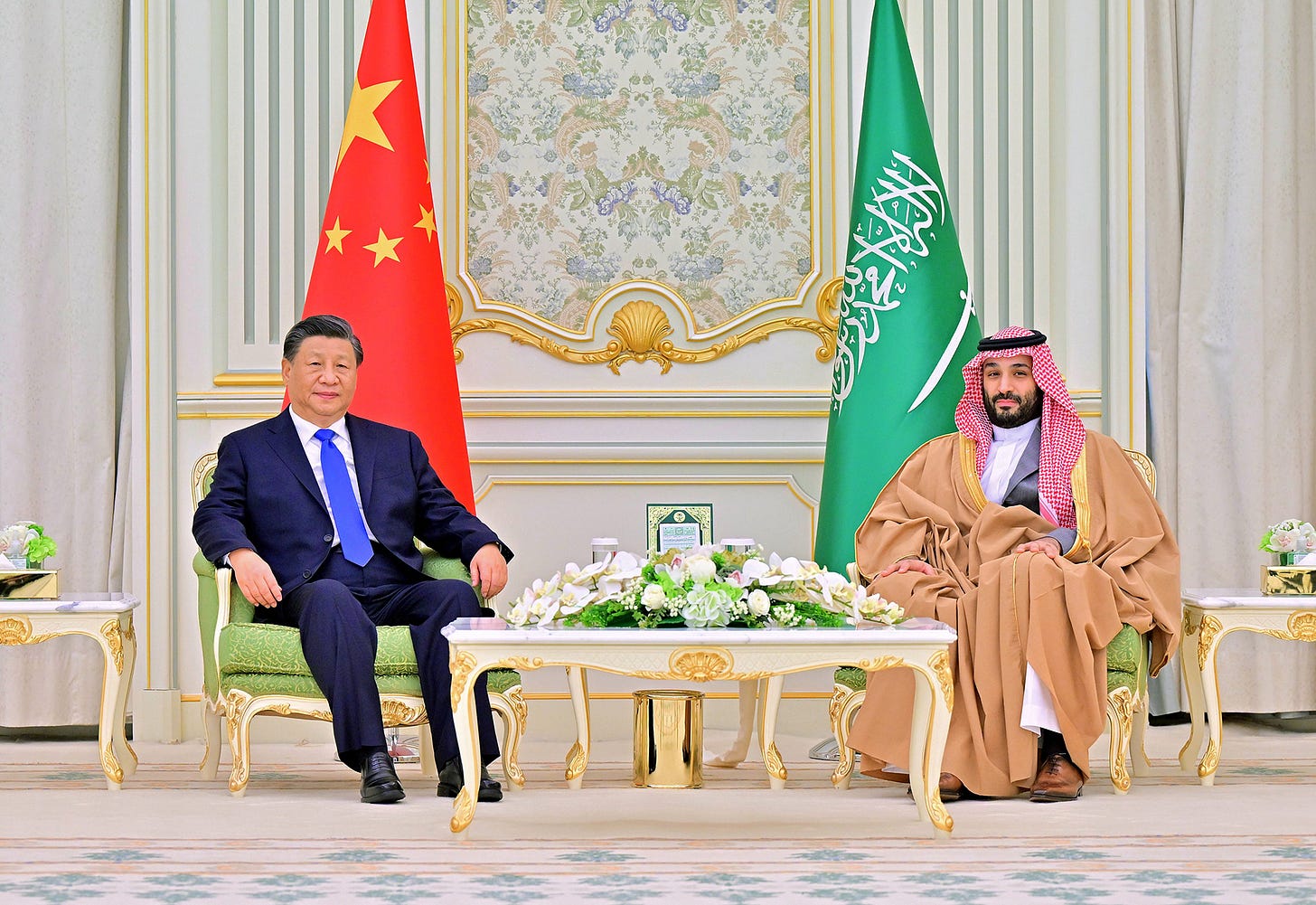

The Trump administration’s policy contradictions perfectly illustrate the impossible position late-cycle leaders face. He has pursued manufacturing revival through tariffs (= fragmentation) while continuing to uphold the dollar's global reserve status (= integration), notably by promoting stablecoins (see below). And as recent AI deals with Saudi Arabia, the UAE and Qatar suggest, he appears to believe the US urgently needs foreign capital—despite running a massive capital surplus, which is itself the flip side of the trade deficit Trump himself so often condemns.

These aren't policy failures but symptoms of technological inevitability. As global institutions that once underpinned free trade weaken, national economies face rising exposure to supply shocks and strategic dependencies. In response, governments are redirecting capital into domestic resilience—often through policies that resemble financial repression. This shift not only reflects deepening geopolitical tensions, but also accelerates the decline of the open, rules-based order many still assume to be in place.

As David Skilling observes, “trade wars are a precursor to capital wars.” In other words, the fragmentation we now see in trade will likely extend into finance. States that once relied on global capital markets are increasingly treating capital as a strategic resource. Thus, as Russell Napier argues, we may be entering an era of “national capitalism”—where governments no longer leave capital allocation to markets but instead channel it toward politically chosen priorities.

This pattern suggests not temporary disruption but the inevitable consequence of a mature technological paradigm pushing against institutions built for a different age.

4/ Why high public debt marks technological maturity

The late-cycle hypothesis holds that high public debt emerges as a regular feature of technological maturity. This is not mainly due to policy mistakes. It stems from two related forces. First, governments and private actors continue to borrow as if the previous growth regime still applies. Second, growth slows, as the technological revolution that once drove expansion begins to plateau.

Each phase of a technological revolution brings a different growth regime. In early phases, new industries fueled by financial capital drive rapid investment and productivity gains. But as technologies mature and diffusion completes, returns diminish, production capital takes over from financial capital, and growth stabilises. If the current techno-paradigm—that of computing and networks—has likely entered this maturity phase, then assumptions about growth, returns and debt sustainability no longer hold.

This helps explain why we may see a return of meaningful inflation. Not the steady 2–3% annual increases favoured by central banks, but sharp, cumulative price shocks. In a conversation with Tyler Cowen, Kenneth Rogoff recently suggested we could face up to 20 percentage points of additional inflation above target over the coming decade—a structural rather than cyclical shift:

Quantitative easing from 2008 to 2020 reflects the problem. Policymakers acted as if the previous regime would return. But if we have now entered the late cycle of the current techno-economic paradigm, those policies enacted in a different context misread the environment. Debt levels rose on the back of forecasts that no longer fit the underlying conditions. QE poured fuel into a growth engine that had already begun to stall.

The numbers speak for themselves. US public debt is at 122% of GDP, or 255% when including households and corporations. France stands at 112% and roughly 300% total. Japan exceeds 260% public debt and 400% total. These levels far exceed those seen during the 1970s inflation, putting enormous pressure on monetary policy to stabilise the system by reducing debt burdens through inflation.

Indeed, the options are few. Governments cannot easily raise taxes—rates are already high and politically constrained. They cannot cut spending in a meaningful way—entitlements dominate budgets and discretionary spending is limited. Nor can they outgrow the debt: technological maturity means slower productivity growth. Thus inflation becomes the only politically viable path.

But inflation has side effects. As prices rise, real interest rates fall—either because central banks lag behind or because they lose the political cover to raise rates meaningfully. This undermines voluntary demand for government bonds. The likely result is financial repression: policies that force domestic savings into public debt, often through capital controls, regulatory mandates or banking rules.

This pattern mirrors the institutional breakdown described in the previous section. As global coordination frays, states reassert control over capital and production. Financial repression becomes not just an economic necessity but part of a broader political shift toward national resilience and reduced exposure to global volatility.

In this context, debt, inflation and repression do not appear as separate problems but as parts of the same late-cycle dynamic. Together, they weaken existing institutions and set the stage for the rise of new intermediaries more adapted to the constraints of a mature economy.

5/ The return of commercial intermediaries

Late-cycle theory predicts that institutional breakdown creates coordination gaps, which private actors step in to fill.

Commerce, after all, is like water—it always finds a way. Historical patterns suggest that when institutions built to support trade collapse during periods of technological maturity, new intermediaries rise to manage what governments can no longer handle.

The 19th century offers a useful precedent. After the Napoleonic wars, banking dynasties like the Rothschilds provided informal global coordination between 1815 and 1875 by placing family members in key European centres. They built sophisticated courier networks to move money and intelligence faster than any rival, creating what Karl Polanyi called “the only supranational link between political government and industrial effort”—a system that contributed to peace and prosperity in Europe over a then-unprecedented 60-year stretch.

A century later, another breakdown of global institutions created a fresh late-cycle opening. Alongside the collapse of the Bretton Woods system came the upheaval in oil markets.

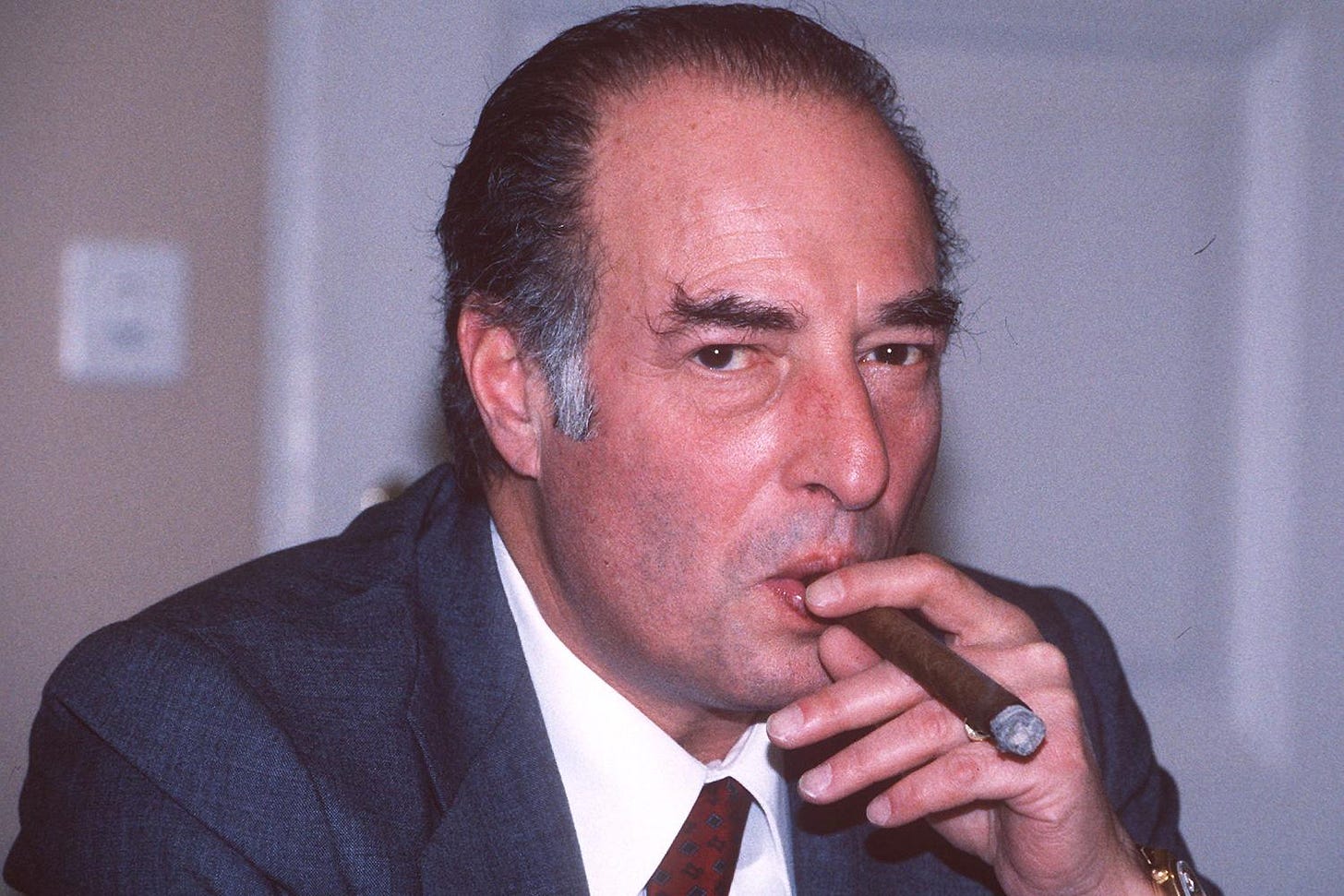

By the end of the 1960s, the “Seven Sisters” oil companies controlled integrated, ultra-optimised value chains from wellhead to petrol pump. Then came the great dislocation: oil-producing countries reclaimed ownership of their reserves through nationalisation. Libya led in 1970, followed by Algeria, Iraq, and the Gulf states. By 1980, national oil companies controlled 70% of global reserves.

This shattered the integrated system and left all sides scrambling. Oil producers no longer knew how to distribute their product. Western buyers no longer knew whom to buy from, or at what price.

Legendary commodity trader Marc Rich and his firm, Marc Rich + Co (now Glencore), responded by inventing the spot market. His traders became finance providers, logistics coordinators, and political fixers all at once—earning huge returns by navigating complexity others found unworkable.

Today's conditions suggest similar openings. As countries assert control over parts of global value chains—in the name of reshoring, resilience, or retaliation—friction grows. The seamless networks that made modern globalisation function now show signs of fragmentation, not unlike what happened with the 1970s oil shock.

A contemporary parallel already exists: Flexport has built a $8 billion business by digitising the anarchic world of freight forwarding. As supply chains fragmented during COVID and geopolitical tensions—with shipping containers stranded in wrong ports, new regulations appearing overnight, and traditional logistics networks breaking down—Flexport's software created visibility where chaos reigned. The company doesn't own ships or planes; it profits by navigating complexity that emerged when just-in-time global logistics collided with pandemic shutdowns and trade wars. Its founder Ryan Petersen has become one of the most sought-after commentators on supply chain fragmentation, precisely because his business model depends on understanding and profiting from the breakdown of seamless globalisation. Like Marc Rich's traders back in the 1970s and 1980s, Flexport makes money because the smooth infrastructure of 2010s globalisation no longer exists.

The theory points us to new figures to watch: trade finance navigators threading capital through competing regulatory regimes; logistics orchestrators managing broken supply chains; political risk specialists brokering triangular relationships between major powers. The most successful will likely see today's fragmentation not as a temporary disruption but a permanent shift. This pattern suggests we are moving back to a world where moving goods, capital, and technology across borders relies not on smooth global markets, but on the rise of sophisticated intermediaries.

6/ Stablecoins and the next monetary order

The late-cycle theory suggests that when global finance becomes fragmented and unreliable, new infrastructure emerges to replace it.

In the past, this took the form of fixed exchange rates or multilateral institutions like the Bank of International Settlements. Today, programmable digital assets—especially stablecoins—may offer the foundation for a new kind of cross-border financial system.

Stablecoins have already reached an impressive scale. They now process over $15.6 trillion a year, comparable to Visa's entire global network. Unlike traditional banking systems, which move money through correspondent banks with delays and hidden fees, stablecoins operate continuously, settle transactions within seconds, and can be programmed to carry out automatic actions—such as releasing funds only after goods are shipped or conditions met.

From this perspective, the US appears to be making a deliberate strategic bet. Most stablecoins in circulation—especially the largest ones, like USDT (issued by Tether) and USDC (issued by Circle)—are pegged to the US dollar and backed by reserves held in US Treasury bills. When someone around the world buys a dollar stablecoin, they indirectly help finance the US government. Demand for these tokens reinforces global demand for dollar-denominated assets.

This creates an interesting parallel to earlier phases of American monetary dominance. After the collapse of the Bretton Woods system in the 1970s, the US maintained its central position in global finance through two key channels:

First, oil was priced in dollars, and oil exporters recycled those dollars into US assets—a system known as petrodollar recycling.

Second, US dollars held and used outside the US—eurodollars—formed the basis of an offshore dollar system that operated beyond US borders but relied on dollar stability.

Stablecoins combine both dynamics. Like petrodollars, they channel foreign demand into US government debt. Like eurodollars, they circulate outside the formal US banking system, traded and held worldwide without ever entering a US bank account.

But stablecoins add something new: programmability. These are not just dollar substitutes; they are financial tools embedded with logic, able to trigger other actions automatically. This gives them the potential to become the base layer of a new digital trade infrastructure.

Yet this creates an inherent tension in the late-cycle thesis: stablecoins simultaneously represent financial innovation (extending US monetary dominance) and enable the fragmentation they're meant to solve. They work precisely because they route around traditional banking—but that same feature makes them harder to control when geopolitical pressures mount.

The evidence points toward currency power in the 21st century coming not from controlling central banks alone, but from setting the rules of digital money—its infrastructure, standards, and rails. In promoting dollar-backed stablecoins, whether deliberately or not, the US may be constructing the next phase of its monetary influence—one that doesn't rely on treaties or military alliances, but on code and network adoption.

This shift carries deep geopolitical implications. History shows that dominant financial powers rarely rise through conquest alone; they win by reducing the friction of trade.

Venice's Stato da Màr did this by building a maritime network of trading posts, contracts, and financial tools that smoothed commerce across the Mediterranean. Venice's strength lay not in controlling territory, but in offering the most reliable and efficient infrastructure for trade—backed by brutal enforcement of contracts and sophisticated financial instruments like the commenda.

Similarly, stablecoin dominance will depend not just on network effects but on legal enforceability, reserve transparency, and integration with real-world commerce.

Stablecoins may be the first serious attempt to replicate that model in digital form. By enabling instant, borderless, and programmable transactions, they offer a foundation for a new kind of financial order—one where influence stems from who builds and controls the rails, not who commands the armies. If these rails come to dominate global trade, then the networks that support them—whether public, private, or something in between—may play the role that Venice, Antwerp, Amsterdam, London, or New York once did. The contest for that role is already under way.

Yet this monetary transformation faces significant headwinds. Central bank digital currencies (CBDCs) represent direct competition—China's digital yuan already processes over $250 billion in transactions, while the ECB advances its digital euro plans. A Tether crisis—whether from regulatory action, reserve questions, or market dynamics—could shatter confidence overnight (not even mentioning a run on US sovereign debt, as argued by Paul Krugman). And unlike the eurodollar system, which emerged organically from banking practice, stablecoins face constant regulatory uncertainty.

All in all, the US benefits from dollar stablecoin dominance today, but that could shift if other nations create more attractive digital currency infrastructure or if trust in Tether's reserves finally breaks.

7/ Why financial markets must be rebuilt in maturity phases

Beyond trade finance, late-cycle theory predicts that a full reconstruction of financial architecture becomes necessary. The boundaries that have shaped investment strategy for decades now show signs of breaking down—reminiscent of the structural shifts that reshaped markets in the 1970s.

That decade marked a turning point. The mass-production model of the post-war economy began to plateau. Inflation surged, growth slowed, and industrial economies faced stagflation. Capital was abundant but often misallocated. Financial institutions, structured for earlier growth phases, struggled to channel funds efficiently. The Big Bang reforms of the era—May Day in New York in 1975, followed by the London Big Bang in 1986—were not just acts of deregulation but essential liberations. They cleared outdated constraints, enabling capital to flow with greater flexibility in a service-based, globalising economy.

We are now at a comparable inflection point, with each major segment of finance showing distinct signs of stress:

Public markets have narrowed through passive investing, concentrating capital in a small group of dominant firms—the “Magnificent Seven”—much like the “Nifty Fifty” did at the end of the 1960s and early 1970s. Liquidity appears abundant in rising markets but evaporates under stress, while price discovery mechanisms weaken as fewer active managers remain to evaluate company fundamentals.

Private markets face equally serious structural challenges: liquidity constraints have tightened dramatically with exits blocked for two years and distributions falling to historic lows, whilst assets age in portfolios as firms struggle to sell and limited partners cannot commit fresh capital. Valuation opacity has worsened as many holdings remain unmarked since 2021, eroding trust between general and limited partners, while complex fee structures continue to extract wealth regardless of performance.

Meanwhile, crypto markets continue to cycle through volatility without the institutional infrastructure needed for stable capital allocation (yet).

The boundaries between those three segments have become increasingly blurred, with companies that should be public remaining private, companies that should be private going public (as seen in the microcap casino where tiny Asian businesses list on US exchanges for speculative pump-and-dump schemes), and some public companies behaving like crypto through meme stock dynamics. None of these markets now possesses sufficient liquidity, depth, and efficiency to fulfil the increasingly complex and diverse financing needs of today's economy.

Late-cycle theory holds that new economic phases require new financial tools. Tokenisation, AI-driven transformation, and a next-generation high-yield market represent the kind of structural shifts needed now. Each has a historical analogue—developments that shaped the financial architecture of the last maturity phase:

Tokenisation goes further than any single financial innovation of the 1970s. It not only addresses liquidity at scale—as Gus Levy's block trading once did—but also redefines how assets are issued, transferred, and managed. By turning equity and credit into programmable tokens, it allows capital to move between private and public forms more freely. Tokens can carry embedded rights, governance rules, and covenants, settle instantly, and operate across jurisdictions. The result is a more continuous, flexible market structure where firms can raise capital as needed and investors can access liquidity without structural reclassification.

For example, when Blackstone's BREIT faced $5.3 billion in redemption requests in late 2022, it had to impose withdrawal limits, trapping investors who needed liquidity. Tokenisation could have allowed partial exits through secondary markets whilst maintaining the fund's core strategy—turning an illiquid crisis into a manageable reallocation.

AI, like the leveraged buyout of the 1980s, offers a way to unlock productivity in mature businesses. The LBO model applied financial pressure to force operational change. Today, the leverage is technological. AI enables firms to redesign core processes—logistics, pricing, customer service, product development—with lasting impact. Private equity is beginning to act on this, acquiring companies not just to cut costs but to embed intelligence into operations. It is no longer about financial engineering; it is about true performance transformation.

Finally, a new high-yield market will be needed to fund the physical infrastructure of the digital economy. In the 1980s, Michael Milken built a credit market for firms traditional lenders ignored—young, fast-growing, high-risk. His work showed that risk could be priced and distributed if better understood, creating a new channel for economic growth. Today, that channel must finance compute, energy, manufacturing, and other capital-intensive sectors critical to long-term competitiveness. These investments are too large for venture and too risky for conventional credit. A modern high-yield framework—transparent, distributed, and digitally native—could channel funds at scale while keeping risk contained.

This analysis suggests financial centres that design and implement instruments suited to this phase will become the primary beneficiaries. As globalised capital flows fragment into more actively managed national systems, demand will grow for infrastructure that can match capital to need—quickly, transparently, and across boundaries.

The next Big Bang in finance may not come by declaration, but by emergence—through technologies that solve for constraints no longer visible in legacy systems.

8/ How manufacturing shapes power in every technological revolution

“Imagine a conflict between a nation of lawyers, accountants, and financiers versus one of metalworkers, machinists, and engineers. Who would you bet on?”

China policy analyst Yanmei Xie poses a stark question that cuts to the heart of late-cycle theory: manufacturing capability determines geopolitical outcomes as technological paradigms mature. Physical production anchors every technological revolution, and the nations that master it shape the global order that follows.

History proves this pattern. When America entered World War II, Detroit's factories—which had perfected mass production through the Model T—pivoted overnight to produce the tanks, aircraft, and ships that decided the war. Roosevelt's “arsenal of democracy” demonstrated that manufacturing strength, not financial sophistication, shapes outcomes when pressures mount.

Manufacturing has anchored every technological revolution. The Industrial Revolution brought mechanised textiles. Steam and railways created concentrated factories linked by transport. Steel, electricity, and heavy engineering introduced scientific management. Oil, cars, and mass production brought standardised parts and the assembly line. Today, computing and networks have created advanced manufacturing—where software and hardware merge to produce systems that adapt, optimise, and coordinate at scale.

Yet for most of the past 15 years, many assumed software alone would define the future. Marc Andreessen's 2011 claim that “software is eating the world” became received wisdom. I myself wrote a 2019 piece titled Does Manufacturing Matter?—and essentially answered “no.”

This was wrong. Manufacturing allows far greater productivity gains than services, which depend on human hours. It scales through specialisation, learning, economies of scale, and spillovers that lift entire sectors. Services, by contrast, struggle to grow without losing quality.

Above all, the current distribution of manufacturing capabilities reveals a stark reality: this capacity is now concentrated in China.

China's rise began with Deng Xiaoping's reforms in 1978. The Communist Party followed a well-documented framework: land reform to free up labour and increase agricultural yields, export-led industrialisation, and financial repression to channel savings into strategic investment.

The central government would label a sector as strategic. Local governments then raced to build clusters around it, knowing economic success could bring political reward. Capital poured in, meeting a vast pool of entrepreneurs. What followed was intense competition—what Arthur Kroeber described as: “China builds an entire industry ecosystem and watches to see which pieces survive.”

This success wasn't just about planning. China mastered imitation-driven innovation—where copying becomes the first step to outpacing rivals. Chinese startups face what Kai-Fu Lee calls “gladiatorial competition,” where copying gets you in the door, but only adaptation and speed keep you there.

The West inadvertently accelerated this process through vast technology transfers. As journalist Patrick McGee documents in his landmark Apple in China, Apple alone invested the equivalent of two Marshall Plans between 2001–2007. In 2016, Tim Cook promised Chinese leaders $275 billion over five years—what Patrick calls “a Marshall Plan for China.” Apple engineers worked on the ground in China, side by side with suppliers, to manufacture whatever design teams could create. This wasn't just about cost—it was about capability. Apple had tried to keep production in the US during the 1990s but failed. Great design meant little without great manufacturing.

As Patrick explains, over time Apple helped train 28 million Chinese workers—more than California's entire workforce. This couldn't have happened elsewhere. It required infrastructure, workforce mobility, and scale. China's floating workforce of migrant labourers moved from site to site, absorbing knowledge and building skills across supply chains.

When Tim Cook observes that all US production engineers fit in a ballroom whilst China needs football fields, he means skills built over decades. What Dan Wang once highlighted as “process knowledge”—how to make production smoother, faster, more reliable—comes not from manuals but from years of assembling billions of devices for export.

This capability now extends far beyond consumer electronics. China makes over 60% of the world's electric vehicles, leads in solar and battery production, and advances in semiconductors despite Western pressure. Nearly every hardware startup ends up there because no one else matches China's mix of speed, quality, and capacity.

And again, this isn't 20th-century assembly-line work. It's advanced manufacturing—software and hardware fused into systems that anchor global power. As Yanmei observes: “Software is vital, but only when paired with hardware—missiles, drones, fighter jets, and semiconductors.” China understood this early.

And so the future doesn't belong to software eating the world. It belongs to manufacturing eating software—embedding intelligence into the physical world. That capability will shape the next global order. And China is now racing well ahead for the prize of winning the maturity phase.

9/ Why AI represents efficiency, not disruption

Late-cycle theory sees AI not as the start of a new paradigm but as an efficiency breakthrough within the current one—like lean production was for mass production.

Just as Toyota, in the 1970s, showed how to produce higher quality goods at lower cost and greater speed without reinventing the car, AI reorganises production around already-mature computing and network infrastructure. It achieves more with less, fitting Clayton Christensen's category of efficiency innovation: better use of existing tools, liberating capital while often displacing labour.

Indeed, the breakthrough isn’t in new technology but in applying it across entire organisations. As I pointed out in a recent edition, AI had already permeated daily tools—Google's autocomplete, DeepL's translation, and others—long before ChatGPT made it visible. ChatGPT didn't mark a technical leap so much as an interface shift: it made AI usable through natural language.

The spectacular speed of adoption confirms this. Within months of ChatGPT’s release, every major tech firm launched similar systems, as hundreds of millions of users were already familiar with GenAI and using it avidly. This wasn’t a response to disruption. It was a sign that AI fit neatly into the computing-and-networks techno-economic paradigm, perfecting rather than replacing it.

(If Apple’s 1984 Macintosh was Radiohead’s Kid A—strange, divisive, and ahead of its time—then OpenAI’s ChatGPT is Michael Jackson’s Thriller: a breakout hit everyone noticed from day one, not because it broke the system, but because it showed just how far that system could go.)

And just as lean manufacturing extended the productive life of mass production by decades, AI now seems poised to extend this paradigm’s lifespan well past its expected decline.

This brings the question back to manufacturing and organisational structure. Firms deploying AI face two paths: replace experienced workers with junior ones using AI, or use AI to amplify the judgment of experienced workers. The second path mirrors Toyota’s lean production achievement—gains through better organisation, not cheaper inputs.

Toyota's success required specific organisational elements: long-term supplier relationships where knowledge accumulated over decades, empowered workers who could stop production lines to fix problems, and a culture of continuous improvement (kaizen) that valued process knowledge. These structures determined who captured lean production's efficiency gains. Western firms that tried to copy Toyota's techniques without its organisational foundation often failed.

Similarly, who captures AI's efficiency gains may depend on comparable structures. Firms need ways to preserve institutional knowledge as AI augments it, mechanisms for workers to correct and improve AI systems based on experience, and patient capital that values long-term capability over quarterly earnings. Without these, AI risks becoming a tool for short-term cost-cutting rather than genuine productivity improvement.

This divergence could alter global production patterns. China's manufacturing strength rests on accumulated process knowledge—tacit understanding built through scale, iteration, and coordination. AI could, in theory, erode that advantage if others learn to preserve and apply process knowledge through AI. But that depends on institutional will.

The US, in particular, may struggle. Its firms often prioritise quarterly earnings over long-term capability. The same short-term mindset that slowed lean adoption in the 1970s could now limit AI's potential. Companies that take the short route—replacing experience with tools—may end up building unstable systems that need constant correction.

China appears to be taking a different approach. Many firms there seem to be pursuing what might be called “AI kaizen”—continuous improvement powered by AI, grounded in deep process knowledge. This reflects the core of lean: tools amplify people, not replace them. The institutions that powered China's rise—strategic planning, value-chain integration, and systematic knowledge-building—now position it well for the AI-powered efficiency revolution, just as Japan's institutional strengths positioned it to lead the lean production revolution.

This analysis suggests AI won’t usher in a new age, but will extend the current one. The rewards won’t go to the best technology alone—they’ll go to those who build the organisational structures to harness it effectively. The key advantage in AI-powered manufacturing isn’t technical, but institutional. And on that front, it’s unclear whether the US has what it takes to catch up with a well-advanced China.

10/ Why the next revolution belongs to China

Late-cycle theory holds that the seeds of a new technological revolution are planted during the maturity of the old. In addition, history shows a clear pattern: nations that lead one revolution seldom lead the next, particularly when success breeds institutional complacency.

Britain led the original Industrial Revolution with canals and textiles, then dominated the age of steam and railways. But it failed to lead the third surge—steel, electricity, and heavy engineering. Why? Success had made London's financiers comfortable with empire and global trade. Funding steel mills in Germany's Ruhrgebiet looked too risky and unfamiliar. Meanwhile, the Krupps and Thyssens—and later Andrew Carnegie's US Steel in Pittsburgh—seized the opportunity that Britain's establishment ignored.

The pattern repeats today. America led the age of oil, automobiles, and mass production centred in Detroit, then dominated computing and networks through Silicon Valley. But like Britain before it, the US now shows classic signs of incumbent resistance. It sits flush with capital from a dominant financial sector and strong foreign demand for US assets. The shale boom has made it energy-secure. Dollar supremacy and unmatched military reach have bred geopolitical overconfidence.

So when clean electrification arrives—likely the defining shift of the next technological revolution—America hesitates.

The irony is stark: Elon Musk, who once aimed to electrify America by linking EVs, batteries, solar power, and construction through Tesla and SolarCity, now backs a political movement openly hostile to renewables. The same entrepreneur who built the world’s most valuable car company on EVs faces policies threatening to cut the federal tax credits that helped Tesla grow. Why this war on renewables? Perhaps solar panels lack the rugged, industrial appeal of oil rigs and coal mines—symbols some Americans see as key to their identity.

China, meanwhile, does what Britain and America once did: it scales the new techno-economic paradigm with systematic intensity.

The turning point came in 2014, when Xi Jinping called for a revolution in China's energy system. This wasn't just policy rhetoric—it marked what Carlota would recognise as the “big bang” moment of a new technological surge. Just as Intel's 1971 microprocessor launch triggered the computing revolution, China's systematic pivot to electrification has unleashed a decade of cost decline and capability building that now appears unstoppable.

The numbers reveal structural change. China consumes nearly 30% of global electricity—over 7,200 TWh annually—creating a natural laboratory for AI-driven energy systems at unprecedented scale. Solar costs dropped 90% in a decade. China manufactures over 60% of global electric vehicles and dominates battery production. It controls the mineral supply chains that feed these industries.

But this goes beyond manufacturing prowess. China is becoming what the Financial Times now calls the world's first “electrostate”—an economy where electricity's rising share of total energy use drives fundamental transformation. The Baochi Energy Storage Station in Yunnan province manages frequency shifts in milliseconds. Ultra-high-voltage transmission lines carry renewable electricity from western deserts to eastern manufacturing centres, creating energy systems that span regions rather than remaining localised. Energy storage capacity has grown twentyfold in just four years. Meanwhile, China builds nuclear reactors in 5-7 years compared to 15-20 years in the West, adding baseload capacity at unprecedented speed to anchor its expanding electrical grid.

What makes this revolutionary isn't just scale—it's programmability. When you combine manufacturing dominance with AI, energy becomes responsive, intelligent, controllable. Like data packets flowing through networks, electricity can be directed, shaped, and optimised in real time. Industrial factories adjust consumption automatically based on pricing signals. Electric vehicles become mobile power stations, feeding energy back during peak demand. Grid-scale batteries don't just store power—they release it precisely when algorithms spot arbitrage opportunities.

This represents something entirely new: energy that thinks, responds, and adapts. As Jonas Janssen of Magnetic Ventures observes, when you power systems with software and AI, energy becomes not just a utility but an intelligent system—the hallmark of a true general-purpose technology revolution.

China's institutional advantages align perfectly with this transition. The same abundant capital, integrated supply chains, and capacity for massive infrastructure projects that built its manufacturing dominance now drive its energy strategy. While Western firms remain constrained by quarterly earnings pressures, China's machinery hums along with decade-long planning horizons.

The geopolitical implications mirror past technological revolutions. In the last cycle, American dominance in computing and networks gave it control over global platforms and standards. Programmable electricity may play a similar role in the next revolution. Nations that master intelligent energy infrastructure will shape trade, pricing, and geopolitics—exactly as semiconductors and internet protocols do today.

Renewable electricity in China is now cheaper than coal, creating economic incentives for adoption regardless of policy. EV sales will surpass internal combustion engines this year—the first major market to reach that tipping point. Meanwhile, America debates electric vehicle subsidies whilst Chinese EVs dominate their home market and expand globally.

The evidence keeps pointing in one direction: towards energy that behaves like information, and towards the nation building this future whilst others debate whether to embrace it. If the pattern holds, the next wave of value creation won't emerge from oil wells or cloud data centres, but from intelligent energy systems built at global scale.

The country best positioned to lead this shift has the manufacturing base, the domestic market, the institutional capacity, and—crucially—the appetite for risk that new technological paradigms demand. This time, the revolution may centre on Shanghai, and Shenzhen rather than Palo Alto.

11/ Where capital goes next

As a conclusion, the patterns explored above suggest three distinct strategic positions emerging from late-cycle dynamics:

America resembles Britain in the mid-19th century: far more interested in expanding its global financial reach than catching the next technological wave. Britain chose empire and finance over steel, electricity, and heavy engineering. America seems to now choose stablecoins and financial sophistication over programmable electricity. Both approaches extend existing advantages whilst potentially missing the next paradigm shift.

China mirrors America at exactly the same moment—around 1870—when the United States was building the industrial foundation that would define the next century. China's systematic energy infrastructure investment since 2014, combined with its manufacturing depth and patient capital, positions it to lead what may become the age of programmable electricity. Just as America's railroads and steel mills enabled its 20th-century dominance, China's intelligent energy systems could provide similar advantages for the decades ahead.

Europe remains mostly an afterthought, despite substantial opportunities. The continent has abandoned manufacturing without building strength in technology, caught between paradigms and excelling at neither. Yet significant work can be done here, as I've explored in my own writing and through Euro Stable Watch, the new trade publication I launched with my friend Marieke Flament to focus specifically on euro stablecoins.

For investors drawn to “what's next,” the late-cycle theory suggests a fundamental shift in approach. Starting next week, I'll dive deeper into these investment implications, examining specific sectors, companies, and strategies that align with late-cycle dynamics. The analysis will cover everything from which public equities benefit from manufacturing's resurgence to how tokenisation creates new financial market opportunities. The goal is to build a practical framework for navigating what may be the most significant inflection point since the dawn of the age of computing and networks.

Sign up to Drift Signal if you don’t want to miss the next issues 🤗

From Normandy, France 🇫🇷

Nicolas

Nicolas,

Your late-cycle investment theory hinges on the point that "we've entered the maturity phase of the computing and networks revolution".

The obvious counter to that point is that we are in the very early days of the artificial intelligence revolution, which many believe will make computing and networks much more dominant in society, with substantial economic and social disruption. You engage with this at point 9, arguing that "AI represents efficiency, not disruption".

My view is that you are not correct that the limited impact of AI to date means that it will not be disruptive in the medium term. Other general purpose technologies (e.g. steam power, electricity, computers) took decades to have a major economic impact.

It is a bold choice to go against the current technological consensus, but it is also a risky wager to propound a new theory that ignores this consensus. (I first encountered your work when I received a copy of your very interesting book Hedge from Azeem Azhar -- I expect that Azeem would strongly question the choice not to bet on AI as a disruptor.)

On the other hand, if you are correct, it will be a very impressive contrarian call!

Maury

Check usd.ai